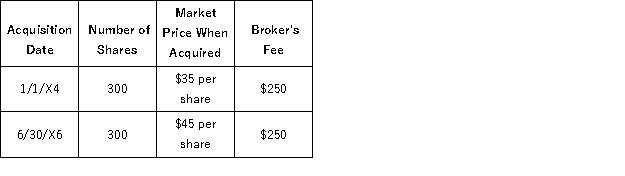

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase):

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Operating Expenses

Costs associated with the day-to-day operations of a business, excluding direct costs of producing goods or services.

Cash Basis

An accounting method where revenue and expenses are recognized when cash is received or paid, rather than when earned or incurred.

External Reporting

The preparation and disclosure of financial statements and other information to parties outside the corporation, typically involving public companies.

Long-Term Assets

Assets that are expected to provide economic benefits beyond one year, including property, plant, equipment, and intangible assets.

Q2: Which of the following is a true

Q9: Taxpayers need not include an income item

Q17: Which one of the following is not

Q20: Which of the following statements regarding tax

Q32: Which of the following is not a

Q47: Which of the following statements regarding for

Q64: To qualify under the passive activity rental

Q80: The business purpose, step-transaction, and substance-over-form doctrines

Q93: Winchester LLC sold the following business assets

Q102: Which of the following decreases the benefits