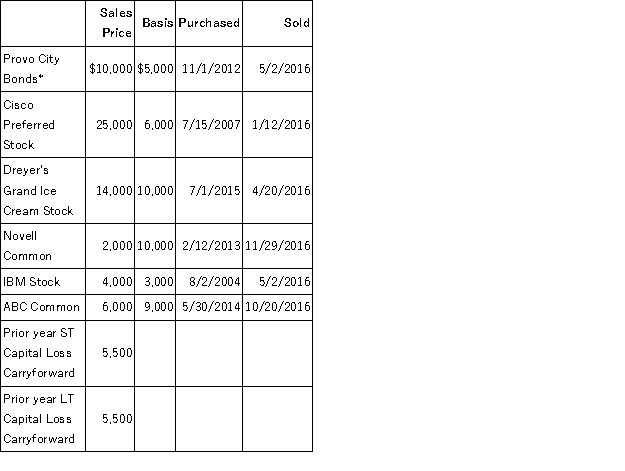

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City

What is the Net Short-Term Capital Gain/Loss reported on the 2016 Schedule D? What is the Net Long-Term Capital Gain/Loss reported on the 2016 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Definitions:

True Lease

A leasing arrangement where the lessor retains substantial risks and rewards of ownership of the leased asset.

Down Payments

Initial payments made when purchasing costly items on credit, representing a fraction of the purchase price.

Lessees

Individuals or entities that obtain the right to use and control a leased asset for a specified period in exchange for payment to the lessor.

Borrow Money

The act of obtaining funds from another party with the promise to return the principal amount along with agreed upon interest.

Q5: For married couples, the Social Security wage

Q12: All of the following are tests for

Q40: In certain circumstances, a married taxpayer who

Q49: The constructive receipt doctrine is more of

Q63: Tyson had a parcel of undeveloped investment

Q64: Which of the following transactions results solely

Q111: Antonella works for a company that pays

Q117: Regular taxable income is the starting point

Q123: Jeremy and Annie are married. During the

Q125: Lebron received $50,000 of compensation from his