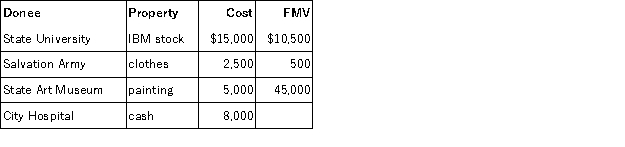

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Definitions:

Missed Opportunity

A situation where a potential benefit or advantageous action is not taken, leading to a lost possibility.

Rent Controls

Government-imposed limits on the amount landlords can charge for leasing residential properties to ensure housing affordability.

Property Taxes

Taxes paid by property owners based on the assessed value of their property, commonly used to fund local public services and infrastructure.

Quota

A specific limit or target for production, sales, or other measurable factors, often set by governments or organizations.

Q11: The phrase "ordinary and necessary" means that

Q30: Lenter LLC placed in service on April

Q33: During August of the prior year, Julio

Q45: Uniform capitalization of indirect inventory costs is

Q78: Loretta received $6,200 from a disability insurance

Q79: The American opportunity credit is available only

Q79: Which of the following courts is the

Q87: Hal Gore won a $1 million prize

Q102: Which of the following assets are eligible

Q128: Hillary is a cash-basis calendar-year taxpayer. During