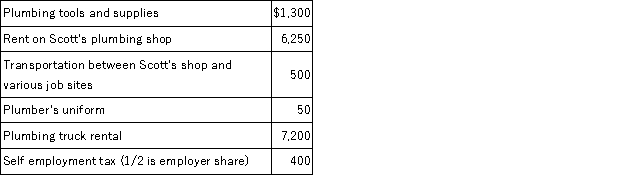

Scott is a self-employed plumber and his wife, Emily, is a full-time employee for the University. Emily has health insurance from a qualified plan provided by the University, but Scott has chosen to purchase his own health insurance rather than participate in Emily's plan. Besides paying $5,400 for his health insurance premiums, Scott also pays the following expenses associated with his plumbing business:

What is the amount of deductions for AGI that Scott can claim this year (2016)?

Definitions:

Sociohistorical Context

The social, historical, and cultural setting and conditions that influence and shape events, behaviors, and perceptions.

Laboratory Science

The field of science that focuses on experiments and analyses conducted in controlled environments, such as labs, to understand natural phenomena or develop new technologies.

Physics

The natural science that studies matter, its motion and behavior through space and time, and the related entities of energy and force.

Zoology

Zoology is the branch of biology that studies animals, their physiology, structure, genetics, behavior, classification, and distribution.

Q3: Assume that Brittany acquires a competitor's assets

Q18: Samantha was ill for four months this

Q39: Which of the following statements regarding the

Q42: Vincent is a writer and U.S. citizen.

Q47: Given that losses from passive activities can

Q64: Which of the following is a true

Q70: How are individual taxpayers' investment expenses and

Q86: Constructive receipt represents the principle that cash

Q88: Which is not an allowable method under

Q95: Geithner LLC patented a process it developed