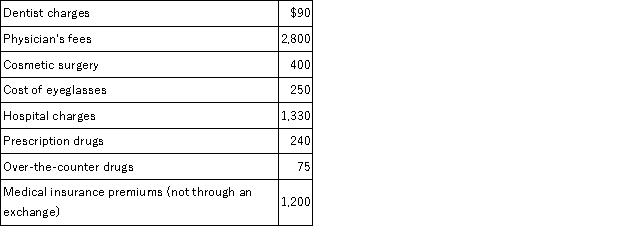

Jenna (age 50) files single and reports AGI of $40,000. This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Definitions:

Intense Response

A strong or extreme reaction to a particular stimulus or event.

Type A Personality

A temperament characterized by high levels of competitiveness, self-imposed stress, and a constant sense of urgency.

Heart Disease

A broad term for a range of diseases affecting the heart, including coronary artery disease, heart rhythm problems, and heart defects among others.

Hostility

Aggressive or antagonistic attitudes or behaviors towards others, which can be overt or covert.

Q17: This year, Jong paid $3,000 of interest

Q17: Irene's husband passed away this year. After

Q22: A taxpayer can avoid a substantial understatement

Q50: Taxpayers may make an election to include

Q60: Qualified production activity income for calculating the

Q66: Martin has never filed a 2016 tax

Q87: An individual may be considered as a

Q87: Assume that Lucas' marginal tax rate is

Q94: David, an attorney and cash basis taxpayer,

Q113: This year Kelly bought a new auto