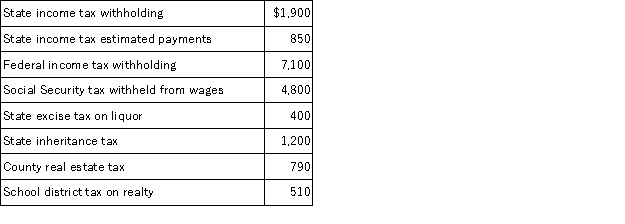

Chuck has AGI of $70,000 and has made the following payments

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Definitions:

Marginal Cost

The additional cost incurred from manufacturing or producing one more unit of a specific product or service.

Profit Maximizing

A financial strategy or goal of businesses to achieve the highest possible profit, where marginal revenue equals marginal cost.

Marginal Revenue

The additional revenue a firm gains from selling one more unit of a good or service.

Monopolist

A market participant that is the sole seller of a product or service, having significant control over its price.

Q8: A tax practitioner can avoid IRS penalty

Q9: Deb has found it very difficult to

Q27: Anna is a 21-year-old full-time college student

Q30: Michelle is an active participant in the

Q50: For alternative minimum tax purposes, taxpayers are

Q54: Leslie made a mathematical mistake in computing

Q65: Qualified dividends are taxed at the same

Q87: Joe is a self-employed electrician who operates

Q92: Assume that Cannon LLC acquires a competitor's

Q117: Certain types of income are taxed at