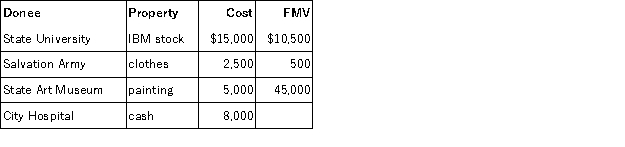

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Definitions:

Maturities

The specific dates on which the principal or nominal amounts of financial instruments like bonds or loans are due to be paid to holders.

Short-Term Securities

Financial instruments, such as Treasury bills or commercial paper, that have maturities of one year or less.

Money Markets

Financial markets where short-term debt instruments, typically with maturities of one year or less, are traded.

Maturities

The dates on which the principal amounts of financial instruments or securities are due to be paid back.

Q13: Eric and Josephine were married in year

Q26: The goal of tax planning generally is

Q45: Lucky owns a maid service that cleans

Q54: Leslie made a mathematical mistake in computing

Q63: Helen is a U.S. citizen and CPA,

Q72: Brad operates a storage business on the

Q84: Rhianna and Jay are married filing jointly

Q98: A taxpayer earning income in "cash" and

Q135: Which of the following is not a

Q148: An 80-year-old taxpayer with earned income and