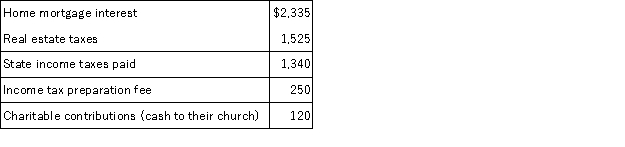

Misti purchased a residence this year. Misti is a single parent and lives with her 1-year old daughter. This year, Misti received a salary of $63,000 and made the following payments:

Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Definitions:

Nondiscriminating Monopolist

A monopolist who charges all consumers the same price for its product or service, unlike price discrimination strategies where different prices are set for different markets or consumers.

Economic Profit

The profit a firm makes after deducting both explicit and implicit costs, reflecting the total opportunity costs of all resources involved.

Profit-Maximizing

A method or strategy that aims to achieve the highest possible profit from business operations.

Average Total Cost

The total cost of production (fixed plus variable costs) divided by the number of units produced, indicating the cost per unit of output.

Q26: Which of the following is a true

Q31: Bryon operates a consulting business and he

Q34: Gambling winnings are included in gross income

Q40: John is a self-employed computer consultant who

Q54: Poplock LLC purchased a warehouse and land

Q68: According to the Internal Revenue Code §162,

Q94: Which of the following audits is the

Q96: This year Norma paid $1,200 of real

Q104: The cash method of accounting requires taxpayers

Q107: Paying dividends to shareholders is one effective