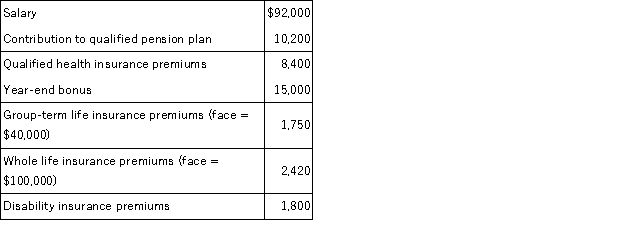

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Definitions:

Federal Agency Regulations

Rules set forth by federal government agencies to govern the conduct of the agencies themselves and individuals or entities regulated by the agencies.

Remedy

The means by which a right is enforced or the violation of a right is prevented, redressed, or compensated through legal procedures.

Uniform Commercial Code

A comprehensive set of laws governing all commercial transactions in the United States.

Commercial Transactions

Refers to the exchange of goods, services, or something of value between businesses or entities, often regulated by commercial law.

Q3: A below-market loan (e.g., from an employer

Q13: Sheryl's AGI is $250,000. Her current tax

Q15: The rental real estate exception favors:<br>A)lower income

Q18: Carly donated inventory (ordinary income property) to

Q39: All business expense deductions are claimed as

Q41: Taxpayers are generally allowed to claim deductions

Q44: This year, Fred and Wilma, married filing

Q50: Which of the following federal government actions

Q61: Roy, a resident of Michigan, owns 25

Q113: The assignment of income doctrine is a