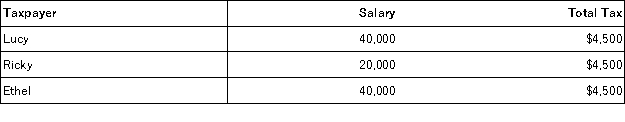

Consider the following tax rate structures. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Definitions:

Form 1040EZ

A simplified tax form for individuals with straightforward financial situations, allowing them to report income and calculate taxes owed.

Taxable Income

The portion of an individual's or corporation's income used to determine how much tax is owed to the government.

Filing Status

A category that describes a taxpayer's marital and family situation, affecting the tax rates and standard deductions they are eligible for.

Tax Liability

The total amount of tax owed by an individual, corporation, or other entity to the taxing authority.

Q8: Use Divergence Theorem to evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg"

Q8: Suppose the temperature in degrees Celsius on

Q9: Find an equation of the tangent plane

Q19: Find the divergence at <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="Find

Q40: Tina has a very complex tax return

Q41: Taxpayers are generally allowed to claim deductions

Q45: In April of year 1, Martin left

Q46: Manny, a single taxpayer, earns $65,000 per

Q71: In a regressive tax rate system, the

Q101: Greg is single. During 2016, he received