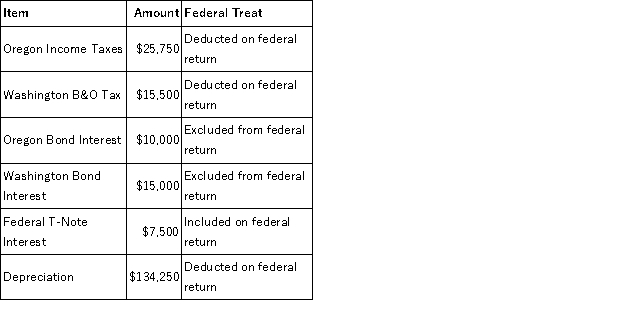

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Definitions:

Product Failure Rate

The frequency at which a product fails within a specified period, often used as an indicator of product reliability.

Full Cost View

An accounting approach that considers all direct and indirect costs involved in producing a product or service.

Breakdown Maintenance

Remedial maintenance that occurs when equipment fails and must be repaired on an emergency or priority basis.

Traditional View

A perspective that prioritizes established practices and views, often resistant to change and innovation in various contexts.

Q1: Use Green's Theorem to evaluate the line

Q4: Find the length of the plane curve

Q8: Find the Jacobian <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="Find the

Q15: Tom Suzuki's tax liability for the year

Q26: Tennis Pro is headquartered in Virginia. Assume

Q27: The Quill decision reaffirmed that out-of-state businesses

Q55: Implicit taxes are indirect taxes on tax-favored

Q87: A tax practitioner can avoid IRS penalty

Q104: Super Sadie, Incorporated manufactures sandals and distributes

Q105: Marc, a single taxpayer, earns $60,000 in