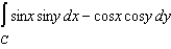

Evaluate the line integral  using the Fundamental Theorem of Line Integrals, where C is the line segment from

using the Fundamental Theorem of Line Integrals, where C is the line segment from  to

to  .

.

Definitions:

Intrinsic Value

The actual, inherent value of a financial asset, determined through fundamental analysis without reference to its market value.

Strike Price

The pre-determined price at which the holder of an option can buy (call option) or sell (put option) the underlying asset.

Call Premium

The amount by which the call price of a bond or other security exceeds its face value, often applicable when the security is called before maturity.

Out-of-the-money

A term used in options trading referring to an option that has no intrinsic value. For a call option, it means the stock price is below the strike price; for a put option, it means the stock price is above the strike price.

Q7: The IRS DIF system checks each tax

Q12: Evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="Evaluate ,

Q13: Match the equation with the graph shown

Q13: The effective tax rate, in general, provides

Q22: Use the properties of the derivative to

Q41: For the following tax returns, identify which

Q57: Which of the items is correct regarding

Q58: Which of the following is not an

Q71: Historically, most states used an equally weighted

Q74: In a planning context,<br>A)closed facts are preferred