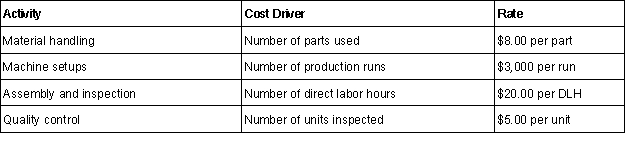

Envision Company uses activity-based costing (ABC) for allocating manufacturing overhead costs to jobs and it has established the following cost drivers and rates:

During July, Job #2005 produced 1,500 units and required the following activity: 1,800 parts, 2 production runs, and 325 direct labor hours.(a.) Calculate the amount of manufacturing overhead applied to Job #2005.(b.) Explain the advantage of using the ABC approach.

Definitions:

Personal Income Tax

A tax levied on the income of individuals, which can vary based on income levels and types of income.

State Excise Tax

Taxes imposed by a state on particular goods or activities, such as alcohol, cigarettes, and gasoline.

Federal Excise Tax

A tax imposed by the federal government on the sale of certain goods and services, such as gasoline, alcohol, and tobacco.

Efficiency Loss

The loss of economic efficiency that can occur when the balance between supply and demand is not achieved or when market conditions lead to a misallocation of resources.

Q8: The balance sheet of an entity:<br>A) shows

Q9: Moped, Inc. purchased machinery at a cost

Q11: The core of politics is<br>A)money.<br>B)power.<br>C)decision making.<br>D)corruption.

Q14: Which of the following states are most

Q22: Poverty is widespread in Russia.

Q30: Which of the following is not a

Q44: The Diamond Manufacturing Company uses a standard

Q44: ABC Company's sales are $100,000, fixed costs

Q51: Simplifying assumptions made when using cost behavior

Q73: Eric Kandel won the Nobel Prize in