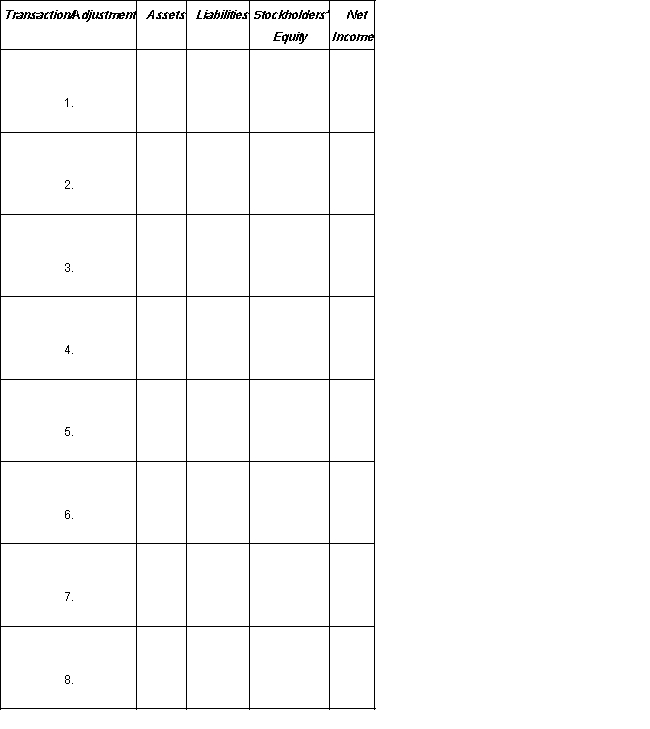

Using the column headings provided below, show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the account name, amount, and indicating whether it is an addition (+) or subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting stockholders' equity.(1.) During the month, the board of directors declared a cash dividend of $2,400, payable next month.(2.) Employees were paid $3,800 in wages for their work during the first three weeks of the month.(3.) Employee wages of $1,200 for the last week of the month have not been recorded.(4.) Merchandise that cost $1,800 was sold for $2,700. Of this amount, $2,000 was received in cash and the balance is expected to be received within 30 days.(5.) A contract was signed with a local radio station for a $200 advertisement; the ad was aired during this month but will not be paid for until next month.(6.) Store equipment was purchased at a cash price of $600. The original list price of the equipment was $800, but a discount was received.(7.) Received $360 of interest income for the current month.(8.) Accrued $620 of interest expense at the end of the month.

Definitions:

Credit Period

The length of time allowed by a creditor for a borrower to make payment on a merchandise or loan without incurring interest or penalties.

Work-in-progress

Inventory that includes materials that have been partially processed but are not yet finished goods in the manufacturing process.

Finished Good

A product that has completed the manufacturing process and is ready for sale to customers.

Raw Material

Basic materials extracted from the environment or produced through agriculture that are used in the manufacture of goods.

Q1: In some studies dealing with processing limitations,the

Q1: Which of the following is not a

Q4: A particular common stock has an annual

Q9: For which of the following reconciling items

Q9: Which of the following descriptions is not

Q11: The term preemptive right pertains to which

Q24: Envision Company uses activity-based costing (ABC) for

Q26: The principle of full disclosure pertains to:<br>A)

Q37: Which of the following is(are) true regarding

Q41: A standard cost or production standard that