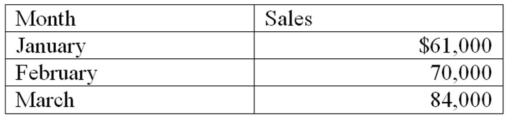

Rosen Hardware Company recorded the following sales for the first quarter of 2012:  These amounts do not include sales taxes.The company is in a state with a sales tax rate of 6 percent.

These amounts do not include sales taxes.The company is in a state with a sales tax rate of 6 percent.

Required:

a)Calculate the amount of sales tax that the company collected from its customers for each month.

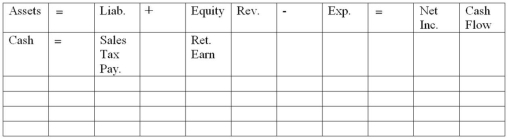

b)For each month,indicate the effect of the sales and collection of sales tax on the statements model,below.Show dollar amounts of increases and decreases; enter NA if an item is not affected.In the cash flows column,designate cash flows as operating activities (OA),investing activities (IA).or financing activities (FA).

c)On March 31,Rosen Hardware remitted to the state the total amount of sales tax for the quarter.Indicate in the statements model the effect of this transaction.

Definitions:

Q19: In accounting for contingent liabilities,Terrace Company determined

Q22: On January 1,2012,Snyder Company spent $820 on

Q36: On November 1,2012,Hardin Company accepted a credit

Q39: Damage to the auditory perception area would

Q50: Describe elimination by aspects using a recent

Q68: Rembrandt Company purchased an asset on January

Q69: In general,experts are better at _ pieces

Q82: Zabinski Co.paid $150,000 for a purchase that

Q109: A 10% preferred stock dividend is declared.The

Q151: Delta Company was accruing interest on a