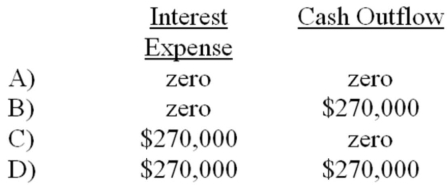

Pella Company issued bonds with a face value of $3,000,000 on January 1,2012.The bonds were issued at face value and carried a 4-year term to maturity.Interest at 9% was payable in cash on December 31 of each year.Based on this information alone,the amount of interest expense shown on the 2012 income statement and the cash flow from operating activities shown on the 2012 statement of cash flows would be:

Definitions:

Spin-off

The creation of an independent company through the sale or distribution of new shares of an existing part of a parent corporation.

Equity Carve-out

A strategy where a parent company sells a minority interest of a subsidiary to outside investors while retaining control.

Shareholders

Individuals or entities that own shares in a company, giving them partial ownership and possibly voting rights.

Strategic Fit

The degree to which an organization's strategies align with its external environment and internal capabilities.

Q1: According to the _ model,expected utility is

Q31: Regarding analogical reasoning,SMT stands for _.<br>A)structured mapping

Q34: Accounting controls are designed to:<br>A) eliminate collusion<br>B)

Q34: Show the effect of a stock dividend

Q65: State the difference between emotion and mood.

Q67: Explain the significance of a high price-earnings

Q97: The amount of uncollectible accounts expense recognized

Q123: Explain the meaning of "internal control" and

Q125: On January 1,2012,Hanson Manufacturing Company purchased equipment

Q133: In 2012,Harvest Corporation recognized an impairment loss