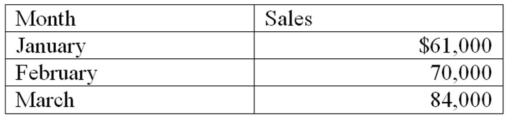

Rosen Hardware Company recorded the following sales for the first quarter of 2012:  These amounts do not include sales taxes.The company is in a state with a sales tax rate of 6 percent.

These amounts do not include sales taxes.The company is in a state with a sales tax rate of 6 percent.

Required:

a)Calculate the amount of sales tax that the company collected from its customers for each month.

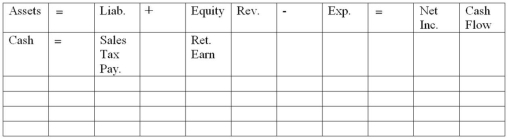

b)For each month,indicate the effect of the sales and collection of sales tax on the statements model,below.Show dollar amounts of increases and decreases; enter NA if an item is not affected.In the cash flows column,designate cash flows as operating activities (OA),investing activities (IA).or financing activities (FA).

c)On March 31,Rosen Hardware remitted to the state the total amount of sales tax for the quarter.Indicate in the statements model the effect of this transaction.

Definitions:

Radio Station

A service that broadcasts audio content to the public or specific audiences via radio waves or digital transmissions.

Charter

A document that establishes the principles, functions, and organization of a corporation, city, or other entity.

Provincial Election

An electoral process to choose representatives for the legislative assembly or parliament of a province within a federal system.

Canadian Citizen

An individual who legally belongs to Canada and has rights and privileges under Canadian law including the right to vote and receive protection.

Q5: The net realizable value of accounts receivable

Q6: In preparing bank reconciliations,typical adjustments to the

Q28: Which type of stock,common or preferred,must all

Q43: On January 1,2012,Ortiz Co.paid $100,000 to retire

Q45: On December 31,2012,Stuart Co.estimated it had $8,000

Q62: To reduce the likelihood of conflicts of

Q66: What is the operating cycle? How is

Q75: Filemyr Corporation,a U.S.business,is a direct competitor of

Q81: Calvert Company sold merchandise for $1,700 cash

Q100: On which financial statement(s)would the account "Loss