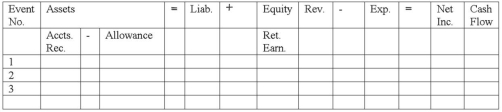

Porter Company experienced the following events during 2012:

1.Recognized $8,400 of service revenue on account

2.Wrote off as uncollectible an account receivable in the amount of $27

3.Prepared adjusting entry to recognize uncollectible accounts expense.Porter expected that 1% of service revenue would not be collected

Required:

Show how each of these events would affect the financial statements model,below.Include dollar amounts of increases and decreases.When an account is not affected by a particular event,indicate with NA.

Definitions:

Q21: Perez Company was founded in 2012 and

Q25: Clark Company paid cash to purchase equipment

Q45: On December 31,2012,Stuart Co.estimated it had $8,000

Q48: Accumulated Depreciation is a temporary account that

Q55: The credit terms,2/10,n/30 indicate that a:<br>A) ten

Q59: The most negative opinion that an auditor

Q80: a)What is the effect on the accounting

Q98: On October 1,2012,Falls Company loaned $10,000 to

Q114: On January 1,2012,Racine Company purchased equipment that

Q131: On November 1,2012,Fain Corporation paid principal and