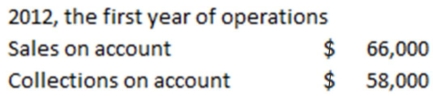

The following information is available for Parsons Corporation,which uses the allowance method of accounting for uncollectible accounts.  Parsons expects 1% of sales on account to be uncollectible.

Parsons expects 1% of sales on account to be uncollectible.

Required:

a)What is the balance of Accounts Receivable at the end of 2012?

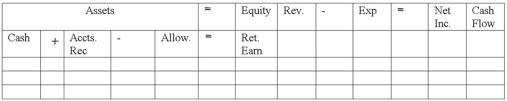

b)What is the amount of uncollectible accounts expense for 2012? Use the financial statements model below to indicate the effect of recording uncollectible accounts expense.Include dollar amounts of increases and decreases.

c)In 2013,after several attempts of collection,Parsons wrote off accounts that could not be collected in the amount of $300.Use the financial statements model that is provided to indicate the effect of the write-off on the financial statements,indicating amounts of increases and decreases.

d)Later in 2013,Erin received a check for $50 from one of the customers whose account had been written off in c)above.Use the financial statements model to indicate the effect of the collection of the $50 on the financial statements,indicating amounts of increases and decreases.

Definitions:

Move Time

The duration it takes to transfer materials or products from one phase of production to another.

Non-value-added Time

Time spent during the production process that does not directly contribute to the final value or quality of the product.

Return On Investment

A performance measure used to evaluate the efficiency or profitability of an investment, calculated by dividing the net profit from the investment by its cost.

Performance Measure

A quantitative indicator used to evaluate the effectiveness or success of an organization, employee, or process in achieving objectives.

Q9: While reconciling Snyder Company's bank statement an

Q12: At March 31,Bandstra Co.had a book balance

Q44: Ransom Co.purchased $10,000 of merchandise inventory on

Q54: Which of the following could describe the

Q63: Which of the following is not an

Q72: The qualified opinion is the most favorable

Q73: At the end of the current accounting

Q104: The Minneapolis Company spent $8,000 to improve

Q140: The face value of Accounts Receivable less

Q152: Define the terms FIFO and LIFO.