Ruthven Company had the following transactions for 2012,the first year of operations:

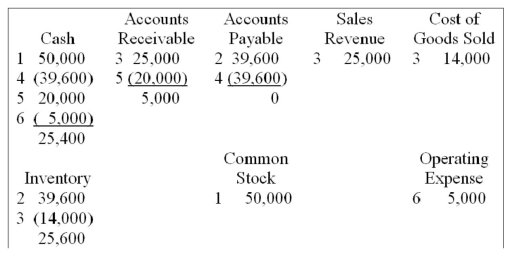

1)Issued common stock for $50,000 cash.

2)Purchased merchandise on account,$40,000,terms 1/10,n/30.

3)Sold merchandise on account for $25,000.The inventory sold had cost $14,000.

4)Paid for the merchandise purchased within the discount period.

5)Collected $20,000 on the merchandise sold on account.

6)Paid operating expense of $5,000.

Required:

a)What are total assets at the end of 2012?

b)What is the balance of the cash account at the end of 2012?

c)What is gross margin for 2012?

d)What is net income for 2012?

e)What are total liabilities at the end of 2012?

f)What is total equity at the end of 2012?

g)What is total retained earnings at the end of 2012?

h)What was the amount of cash flows from operating activities?

Definitions:

Short-term Borrowing

Loans or debt obligations that are expected to be paid back within a short period, typically less than one year, often used for operational expenses.

Carrying Costs

Expenses associated with holding or storing inventory over a period of time, including insurance, storage, and depreciation.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed in the business within one year or within the normal operating cycle.

Investment

The allocation of resources, such as time, money, or effort, in expectation of future benefits or returns.

Q12: At March 31,Bandstra Co.had a book balance

Q19: During the month of March,Wang Company collected

Q26: The amount of uncollectible accounts expense recognized

Q40: What effect does the recording of revenue

Q42: According to Newton's second law,the angular acceleration

Q47: The Earth's gravity exerts no torque on

Q49: The quantity "strain" expressed in terms of

Q54: When a point on the rim of

Q64: What amounts will Siebens report on its

Q127: Stanton Company recognized $5,000 of depreciation expense.