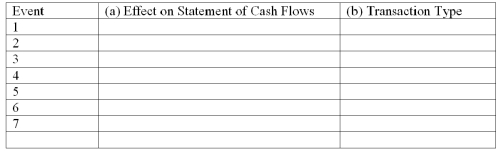

The following transactions apply to Fort Bend Corporation:

1)Issued common stock for $21,000 cash

2)Provided services to customers for $28,000 on account

3)Purchased land for $18,000 cash

4)Incurred $9,000 of operating expenses on credit

5)Collected $15,000 cash from customers

6)Paid $7,000 on accounts payable

7)Paid $2,500 dividends to stockholders

Required:

a)Identify the effect on the Statement of Cash Flows,if any,for each of the above transactions.Indicate whether each transaction involves operating,investing,or financing activities and the amount of increase or decrease.

b)Classify the above accounting events into one of four types of transactions (asset source,asset use,asset exchange,claims exchange).

Definitions:

Q3: How is the balance sheet of a

Q13: A 4.0-kg mass is placed at (3.0,4.0)m,and

Q20: How is a business's certified check treated

Q39: What is the effect on the accounting

Q48: How much air must be pushed downward

Q104: A company's outside,independent auditors are responsible for

Q106: In preparing a bank reconciliation,is a deposit

Q109: The conservatism principle<br>A) is primarily concerned with

Q110: Assets are listed on the balance sheet

Q129: Accounts that are closed include expenses,dividends,and unearned