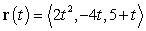

For the parametrization  , find the unit normal vector at

, find the unit normal vector at  .

.

Definitions:

Natural Monopolies

A market condition where due to high infrastructure costs or significant barriers to entry, a single company can supply a product or service more efficiently than multiple competing firms.

Government Regulation

The establishment of rules and laws by government bodies that are intended to control or govern conduct and practices within various sectors.

Price Discrimination

A pricing approach in which the same provider sells the same or nearly the same products or services for different prices in distinct markets or to various customers.

Q4: The highest percentage of Canadians aged 65

Q5: The index of age that represents a

Q16: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Let be

Q29: Calculate the arc length of the curve

Q34: A moving particle is following the path

Q43: Approximate the arc length of the curve

Q49: Find the gradient of the function <img

Q63: Convert the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Convert the

Q80: Evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Evaluate where

Q85: Find the circulation of the field <img