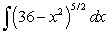

Evaluate the integral  .

.

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in an equal annual amount.

Working Capital

The discrepancy between a firm's immediate assets and its short-term obligations, showcasing the business's liquidity and how effectively it operates.

Renovation Expense

Costs incurred to update, restore, or adapt a part of a building or facility for improved functionality or appearance.

Straight-Line Depreciation

Straight-line depreciation is a method of evenly distributing the cost of a tangible asset over its useful life.

Q5: Which of the following is a correct

Q10: Evaluate the integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Evaluate the

Q27: Solve the following differential equations.<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg"

Q39: Sketch the graph of the following function.

Q49: Evaluate the integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Evaluate the

Q51: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Find and

Q61: Find the work required to move an

Q62: Find the speed and arc length of

Q63: Calculate the population within a 4-mile radius

Q80: A glass of cold water with initial