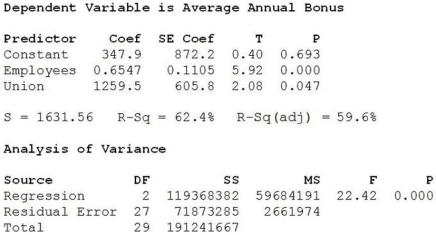

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). Below are the multiple regression results.  a. Write out the estimated regression equation.

a. Write out the estimated regression equation.

b. Are all of the independent variables significant in this regression equation (using α = 0 .05)? Explain.

c. Interpret the coefficient of the Union.

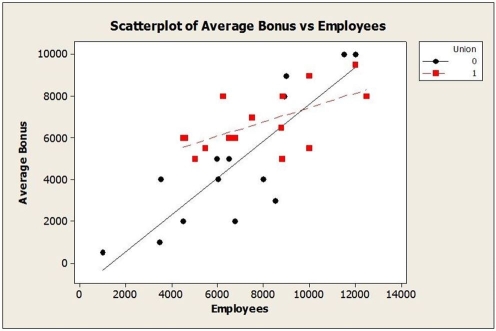

d. Based on the scatterplot below, do you think using Union as an indicator variable in this model is appropriate? Explain.  e. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.

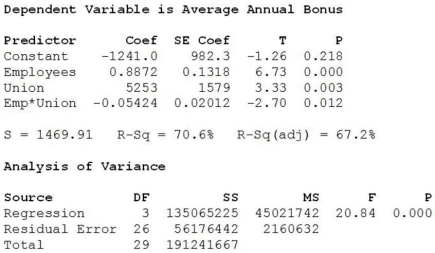

e. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.  f. Using the better model, predict the annual average bonus for a company with 7500 employees that are not unionized.

f. Using the better model, predict the annual average bonus for a company with 7500 employees that are not unionized.

Definitions:

Corporations Act

The legislation governing corporate practices, including financial reporting and corporate governance, in particular jurisdictions such as Australia.

Just and Equitable

Principles used in legal contexts to ensure fairness and justice in the application or interpretation of laws or regulations.

Liquidation

The process of winding up a company's financial affairs by selling assets to pay off liabilities, with any surplus distributed to shareholders.

Preference Shares

Preference shares are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued.

Q1: How much of the variability in Job

Q2: What is the associated P-value?

Q3: If a parameter is computed from a

Q5: What is the correct value of the

Q9: Trying to estimate possible collinearity in the

Q16: The company's lawyers insist that not more

Q18: For each of the following scenarios, indicate

Q28: In this context, describe the Type II

Q52: After computing a confidence interval, the investigator

Q78: Find the points of discontinuity and state