Consider the following to answer the question(s) below:

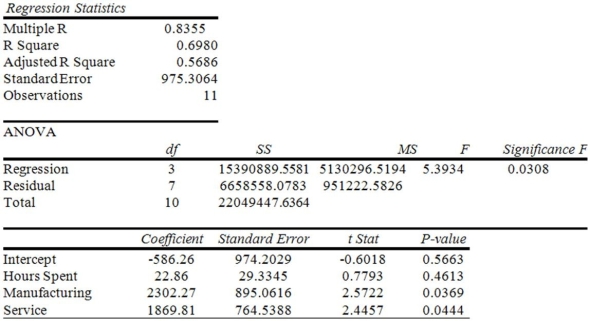

A Toronto accounting firm estimated a model to explain variation in client profitability. The dependent variable is client net profits and the predictor variables include the hours spent working on the client and indicator variables to denote the type of client-manufacturing, service, or government. The indicator variables have a value of one if the client is the type described. The following are the model results.

-If the number of hours spent on a client is 100, and the client is in the Service industry, what is the predicted net profit?

Definitions:

Perfect Competitor

A theoretical market structure where numerous small firms compete against each other without having any significant market power.

Output

The total amount of goods and services produced by an economy or a firm.

MC

Marginal Cost, which refers to the increase or decrease in the cost of producing one additional unit of a good or service.

ATC

stands for Average Total Cost, which is the sum of all production costs divided by the quantity of output produced; it combines average fixed and variable costs.

Q6: Data were collected for a sample of

Q7: Which of the following is a correct

Q8: The minimax choice<br>A) minimizes the maximum cost.<br>B)

Q10: A management professor was teaching a course

Q14: Referring to the figure, find the equation

Q23: The standard deviations (in thousands of dollars)

Q26: Based upon the regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6867/.jpg"

Q29: In this context, describe the Type II

Q37: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Let and

Q62: What is probability that the sample proportion