Consider the following to answer the question(s) below:

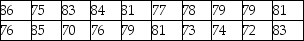

Insurance companies track life expectancy information to assist in determining the cost of life insurance policies. Last year the average life expectancy of all policyholders was 77 years. ABI Insurance wants to determine if their clients now have a longer life expectancy, on average, so they randomly sample some of their recently paid policies. The insurance company will only change their premium structure if there is evidence that people who buy their policies are living longer than before. The sample has a mean of 78.6 years and a standard deviation of 4.48 years.

-Write the null and alternative hypotheses.

Definitions:

Current Ratio

A financial ratio that measures a company's ability to pay off its short-term liabilities with its short-term assets, providing a snapshot of financial health.

Short-Term Debt Paying Ability

Measures a company's capacity to meet its short-term obligations using its current assets.

Receivables Turnover

A financial metric that measures how efficiently a company collects cash from its credit sales by dividing credit sales by the average accounts receivable.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its current assets.

Q1: According to the maximin approach, the group

Q4: A producer of specialty products uses a

Q4: The correct null hypothesis is<br>A) mean vitamin

Q9: A consumer research group is interested in

Q15: Suppose that 6 economists who work for

Q17: What is the critical value for α

Q21: The calculated F-statistic to determine the overall

Q26: A major textbook publisher has a contract

Q43: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="Find if

Q67: What is the probability that a randomly