Consider the following to answer the question(s) below:

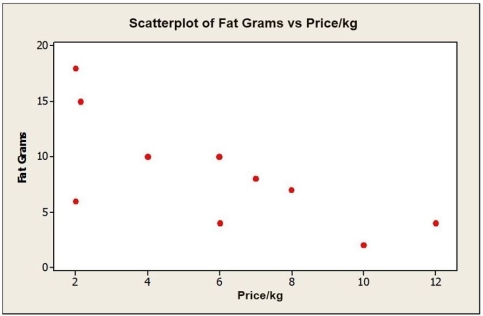

A consumer research group investigating the relationship between the price of meat (per kilogram) and the fat content (grams) gathered data that produced the following scatterplot.

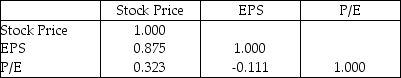

-Shown below is a correlation table showing correlation coefficients between stock price, earnings per share (EPS) , and the price/earnings (P/E) ratio for a sample of 19 publicly traded companies. Which of the following statements is false? Correlation: Stock Price, EPS, P/E

Definitions:

Defined Contribution Plan

A retirement plan where an employee, employer, or both make contributions on a regular basis, but the final benefit received depends on the plan's investment performance.

Risk-free Return

The theoretical return on an investment with zero risk of financial loss, typically associated with government bonds.

Standard Deviation

A statistical measurement that depicts the variation or dispersion of a set of values, commonly used in finance to measure the volatility or risk of an investment.

Defined Contribution Plan

A type of retirement savings plan where the amount contributed to the plan is defined, but the future benefit amounts are not guaranteed.

Q3: Eight hybrid cars are used to determine

Q6: Assuming that all four of the following

Q11: Suppose the Wilcoxon signed-rank test was used

Q17: The correct value of the test statistic

Q17: The intercept of the estimated regression line

Q21: Suppose that ten new smart phone models

Q23: Which of the following is true about

Q24: Function template back_inserter returns:<br>A) A container.<br>B) An

Q24: Overloaded operators can be used to test

Q25: Suppose the unary ! operator is an