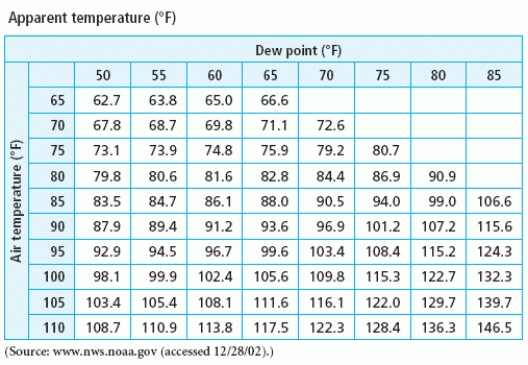

Consider the table of apparent temperatures (given below) , which shows the apparent temperature (how hot it feels) given air temperature and dew point. In order to model apparent temperature as a function of the dew point when the air temperature is  which variable must be held constant?

which variable must be held constant?

Definitions:

Excise Tax

A tax imposed on specific goods, services, or transactions, often with the aim of reducing their consumption or raising government revenue.

Lung Cancer

A type of cancer that originates in the lungs, often associated with smoking and exposure to hazardous pollutants.

Benefits-Received Tax

A taxation principle where taxes are levied on individuals based on the benefits they receive from the government's use of the collected tax.

Vertical Equity

A principle in taxation that proposes taxpayers with a greater ability to pay, such as higher income levels, should pay more in taxes than those with lesser ability to pay.

Q4: The height h, in feet, of a

Q9: The relation u gives the number of

Q9: Consideration is a universal requirement in almost

Q18: Under the blue-pencil rule, a court can

Q22: The most important source of contract law

Q22: Which of the following is true according

Q29: In Katko v. Briney, the plaintiff was

Q30: The number of private donations received by

Q47: Find the derivative of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6775/.jpg" alt="Find

Q49: The acceleration of a race car during