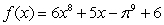

Calculate the derivative of the function with the appropriate formula.

Definitions:

Bond Value

This refers to the present value of a bond's future interest payments plus the face value of the bond when it matures, essentially the price at which a bond is traded.

Credit Default Swaps

Financial derivative contracts that transfer the credit exposure of fixed income products between parties, used as a form of insurance against default on loans or bonds.

Interest Rate Risk

Interest rate risk is the potential for investment losses due to fluctuations in interest rates, affecting the value of fixed-income securities inversely.

Protection Sellers

Protection sellers in a financial context typically engage in credit derivatives markets, selling credit protection to hedge against the risk of default on underlying credit assets.

Q1: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6775/.jpg" alt="Find

Q4: Without government intervention, monopolies would likely occur,

Q5: Which of the following is true in

Q6: When Congress uses its power under the

Q7: A process to extract pectin and pigment

Q9: In what ways can tortuous interference be

Q22: The law of negligence requires us to

Q30: Assume the rate of change in the

Q32: The primary measure of monopoly power is

Q44: Refer to Fact Pattern 21-3. Under the