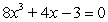

Prove that  has exactly one solution.

has exactly one solution.

Definitions:

Section 1231 Gain

A gain from the sale or exchange of property used in a business or trade that is treated as capital gain for tax purposes, providing tax advantages.

Section 1245 Gain

A tax term referring to the gain from the sale or disposal of certain types of depreciable property, where the gain is recaptured as ordinary income.

Ordinary Income

Refers to the type of income earned by an individual that is subject to standard tax rates, including wages, salaries, commissions, and income from interest or dividends.

Long-Term Capital Losses

Losses incurred from selling assets that have been held for over a year, which can be applied to counterbalance capital gains when calculating taxes.

Q15: Evaluate the integral exactly. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5869/.jpg" alt="Evaluate

Q22: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5869/.jpg" alt="Evaluate the

Q29: Use the given graph to sketch the

Q34: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5869/.jpg" alt="Evaluate the

Q52: Find parametric equations of the line through

Q70: A projectile traveling with momentum 4 kg

Q71: Find the acceleration function for the given

Q71: Find the general antiderivative. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5869/.jpg" alt="Find

Q107: Sketch a graph of a function with

Q112: Find the absolute extrema of the given