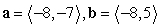

Compute a + b.

Definitions:

Revenue Ruling

An official interpretation by the IRS on how the law is applied to a specific set of facts.

Tax Rate Structure

Describes how tax rates progress from low to high depending on income levels, assets, or transactions, varying from progressive, regressive, or proportional.

Progressive

A taxation system in which the tax rate increases as the taxable amount increases, often applied to income tax.

Regressive

In taxation, regressive describes a tax that takes a smaller percentage of income as the income increases, often placing more burden on lower-income individuals.

Q14: Find all points at which the two

Q26: When an interviewer unintentionally and mistakenly checks

Q36: Find the recurrence relation for the general

Q53: A weight hanging by a spring from

Q63: Find the directions of maximum and minimum

Q65: Find the outward flux of F over

Q76: Convert <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5869/.jpg" alt="Convert to

Q84: A function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5869/.jpg" alt="A function

Q97: Find the osculating circle at the given

Q105: Compute the slope of the line tangent