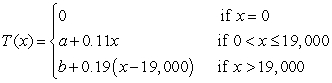

Suppose that a state's tax code states that tax liability is  % on the first

% on the first  of taxable earnings and

of taxable earnings and  % on the remainder. Find the constants a and b in the tax function T(x) that make the function T(x) continuous.

% on the remainder. Find the constants a and b in the tax function T(x) that make the function T(x) continuous.

Definitions:

Price Elasticity

The measure of how much the quantity demanded of a good responds to a change in its price.

Demand Schedule

A table that shows the quantity of a good that consumers are willing to purchase at different prices.

Total Revenues

The total amount of income generated by the sale of goods or services before any expenses are subtracted.

Perfectly Inelastic

A market demand situation where the quantity demanded remains constant regardless of changes in price.

Q5: Determine the values of a and b

Q27: Find the curvature of the polar curve

Q32: Determine <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5869/.jpg" alt="Determine when

Q36: Find the domain of the function. <img

Q42: Neural networks are a form of artificial

Q54: In a focus group discussion, when the

Q58: A specific performance criterion upon which a

Q78: Find an equation of the given plane.

Q80: Predicting next month's dollar sales based on

Q121: Which of the following sets of parametric