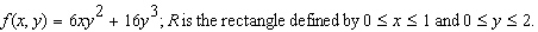

Evaluate the double integral  for the given function f(x, y) and the region R.

for the given function f(x, y) and the region R.

Definitions:

Antitrust Activities

Actions or practices that stifle competition, violate antitrust laws, and are aimed at establishing or maintaining a monopoly.

World Trade Organization

An international organization that regulates international trade with the aim of ensuring trade flows as smoothly, predictably, and freely as possible.

Trade Agreements

Formal agreements between countries that determine the rules of trade between them, including tariffs, import quotas, and product standards.

Trade Disputes

Conflicts that arise between countries or businesses over aspects of trade, including tariffs, trade barriers, or disagreements on trade agreements.

Q7: Data collection should be for a purpose

Q10: This phenomenon refers to a probability experiment

Q11: Each the statements below are examples of

Q11: Why are viruses not considered by most

Q13: Which statement below captures the big idea

Q16: The spending (in billions of dollars) by

Q17: 21st Century teachers need to support students

Q28: The membership of the Cambridge Community Health

Q172: The management of the Titan Tire Company

Q234: Determine the value of the constant <img