Oil Quality and Price

Quality of oil is measured in API gravity degrees--the higher the degrees API,the higher the quality.The table shown below is produced by an expert in the field who believes that there is a relationship between quality and price per barrel.

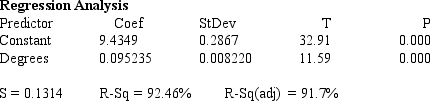

A partial Minitab output follows:

-In a simple linear regression model,testing whether the slope 1 of the population regression line could be zero is the same as testing whether or not the population coefficient of correlation equals zero.

Definitions:

Federal Law

Laws passed by the national government of the United States that are applicable throughout the country.

Defense of Marriage Act

A now-invalidated US law that defined marriage as the union between one man and one woman for federal and inter-state recognition purposes.

U.S. Supreme Court

The highest federal court in the United States, consisting of nine Justices and having ultimate appellate jurisdiction over all federal and state court cases that involve a point of federal law.

Congress

The branch of the United States federal government responsible for creating laws, made up of the Senate and the House of Representatives.

Q3: Why must a CPA issue a report

Q14: At the 0.01 level of significance, what

Q19: For testing the difference between two population

Q28: When comparing two population variances, we use

Q44: The analysis of variance (ANOVA) technique analyzes

Q46: Conduct a test of the population coefficient

Q47: Codes of Professional Conduct " are organized

Q72: A multiple regression model is assessed

Q147: A prediction interval is used when we

Q201: Given the least squares regression line <img