Income and Education

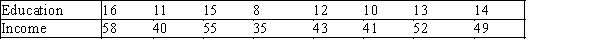

A professor of economics wants to study the relationship between income (y in $1000s)and education (x in years).A random sample eight individuals is taken and the results are shown below.

-{Income and Education Narrative} Determine the least squares regression line.

Definitions:

AGI Deduction

Adjustments made to gross income to calculate the adjusted gross income (AGI), which can include contributions to retirement accounts, student loan interest, and other eligible deductions.

FICA Taxes

FICA taxes are federal payroll taxes collected to fund Social Security and Medicare, divided into equal parts paid by employers and employees.

Student Loan Interest

The cost incurred from borrowing funds for education, which can often be deducted from taxable income under certain conditions in many tax jurisdictions.

Deduction Limit

The maximum amount that can be subtracted from taxable income for certain expenses, beyond which deductions are no longer permitted or are reduced.

Q28: The sum of squares for error (SSE)

Q46: In the one-way ANOVA where there are

Q64: Calculate the Pearson correlation coefficient. Interpret the

Q65: {Life Expectancy Narrative} Is there sufficient evidence

Q72: In the least squares regression line <img

Q95: Fisher's least significant difference method (LSD) substitutes

Q100: In a multiple regression analysis, there are

Q107: A multiple regression model has the form

Q114: Tukey's multiple comparison method is based on

Q147: SSE stands for _ of squares for