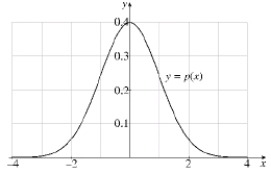

Intelligence Quotient (IQ) scores are assumed to be normally distributed in the population. The probability that a person selected at random from the general population will have an IQ between 100 and 120 is given by Use the graph of p (x) graphed below to answer the questions which follow:

(a) Use Simpson's Rule with n = 4 to approximate

(b) The probability that a person selected from the general population will have an IQ score between 80 and 120 is given by What is the approximate value of (c) Since p (x) represents a probability distribution, the entire area of the region under the graph is exactly 1. Using this information, what is the approximate probability that a person selected at random from the general population will have an IQ score over 120?

Definitions:

Marginal Tax Rate

The rate at which an additional dollar of income is taxed, representing the percentage of tax applied to the last dollar earned.

Tax-Free

Tax-free describes goods, transactions, or income that are not subject to taxation by the government.

Taxed

Subjected to a financial charge or levy by a government on income, goods, or activities.

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, resulting in those who have higher incomes being taxed at a higher rate.

Q6: Find the minimum value of the

Q21: Find the absolute maximum and minimum

Q29: Find the value of <span

Q103: A supply function is given by

Q115: Find a formula for the general

Q149: Find the solution to the differential

Q150: Which of the given differential equations

Q205: The graph of a function f

Q229: Two cars start moving from the

Q319: Determine the limit of the sequence