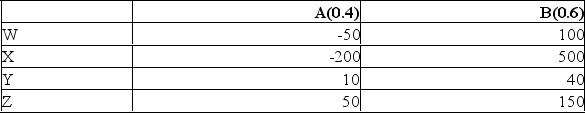

Consider the following decision table in which w, x, y, and z are decision alternatives and A and B are the two possible states of nature, with probabilities 0.40 and 0.60.  The expected value for decision Y is ___________.

The expected value for decision Y is ___________.

Definitions:

Flotation Costs

Expenses incurred by a company in issuing new securities, including underwriting, legal, registration, and printing fees.

Expected Inflation

The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling, as anticipated by consumers, investors, and economists.

Cost of Capital

The Cost of Capital is the cost of a company's funds (both debt and equity), or, from an investor's point of view, the required rate of return on a portfolio company's existing securities.

Specific Financing

Financing that is intended for a particular purpose or project, with clear specifications and usually backed by specific collateral.

Q1: The production of antimicrobial peptides is one

Q5: Secretory IgA produced in the epithelium of

Q12: Individuals with peanut allergies can exhibit a

Q13: Determine the expected opportunity loss for the

Q17: i. For a contingency table, the expected

Q21: The personnel manager is concerned about absenteeism.

Q76: At a recent automobile show, a sample

Q87: Six people have declared their intentions to

Q90: A student asked a statistics professor if

Q119: A sales manager for an advertising agency