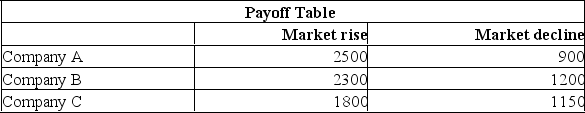

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of stock purchased under conditions of certainty is $120.

iii. The Expected value of stock purchased under conditions of certainty is $440.

Definitions:

Subsidizing Farmers

The practice of providing financial assistance to farmers by the government to encourage agricultural production and ensure food security.

Political Jurisdictions

Defined areas under the authority of certain governmental entities where specific laws, regulations, and powers are applied and enforced.

Urban Sprawl

The uncontrolled expansion of urban areas into the surrounding countryside, often characterized by low-density residential development, increased reliance on personal vehicles, and loss of natural habitats.

Low-Cost Gasoline

Gasoline that is available at a lower price, often due to government subsidies, regional availability, or lessened environmental regulations.

Q10: Naive B and T lymphocytes are small,

Q18: When a mixture of different IgG antibody

Q20: Data for selected vegetables purchased at wholesale

Q29: Important information can be learned by studying

Q31: Marginal zone B cells are thought to

Q34: The information below is from the multiple

Q47: Which of the following can be used

Q71: The following summary is from home heating

Q119: The information below is from the multiple

Q126: i. The null hypothesis in the goodness-of-fit