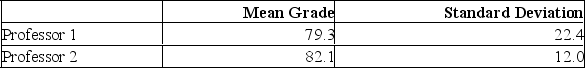

Two accounting professors decided to compare the variation of their grading procedures. To accomplish this, they each graded the same 10 exams with the following results:  What is the critical value of F at the 0.05 level of significance?

What is the critical value of F at the 0.05 level of significance?

Definitions:

Capital Structure

The mix of a company's long-term debt, specific short-term debt, common equity, and preferred equity, which is used to finance its overall operations and growth.

Common Share Equity

The amount of money that would be returned to shareholders if a company's assets were liquidated and all its debts repaid, representing ownership in a corporation.

Dividend Income

Income received from owning shares in a company, typically distributed from the company's profits.

Target Capital Structure

The optimal mix of debt, preferred stock, and common equity that a company aims to achieve for financing its operations and growth.

Q5: i. Besides measuring change in the prices

Q7: i. The multiple standard error of estimate

Q24: A multiple regression analysis showed the following

Q37: An experiment involves randomly selecting a sample

Q70: In a multiple regression analysis, the following

Q70: A manufacturer claims that less than 1%

Q73: A random sample of 25 executives from

Q79: Which of the following is not a

Q105: i. The technique used to measure the

Q162: The following table shows the number of