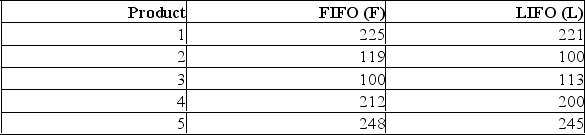

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

If you use the 5% level of significance, what is the critical t value?

Definitions:

NPV

Net Present Value, a method used in capital budgeting to evaluate the profitability of an investment or project by discounting future cash flows to their present value.

Cost Of Capital

The rate of return a company must earn on its investment to maintain its market value and attract funds. It represents the cost of a company to secure funds, whether through debt or equity.

Capital Component

One of three sources of capital: debt, preferred stock, or equity.

Required By Investors

Refers to the expectations or conditions that investors demand before committing capital to an investment.

Q3: A sample of 500 evening students revealed

Q24: Accounting procedures allow a business to evaluate

Q42: i. A continuity correction compensates for estimating

Q61: Two accounting professors decided to compare the

Q73: Dr. Patton is a professor of English.

Q74: A manager of a local store wants

Q94: A sample of 50 is selected from

Q104: A survey of 25 grocery stores revealed

Q105: Determine the z-score associated with an area

Q112: Given the following five points: (-2,0), (-1,0),