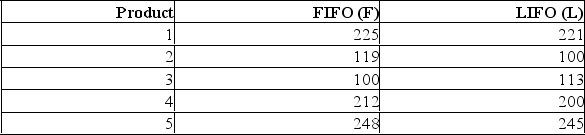

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Antipyretic

A medication or substance used to reduce fever.

Sedative

A substance that induces sedation by reducing irritability or excitement.

Increased Intracranial Pressure

Increased Intracranial Pressure occurs when the pressure inside the skull rises, potentially leading to severe neurological damage due to the compression of brain tissues.

Clustering Nursing Activities

The practice of organizing patient care tasks together to improve efficiency and effectiveness in nursing care.

Q9: The Jamestown Steel Company manufactures and assembles

Q10: (i. About 95.5% percent of the

Q26: The following table shows the number of

Q87: (i. The proportion of the area under

Q89: A group of statistics students decided to

Q106: Recently, students in a marketing research class

Q112: A manager of a local store wants

Q112: In a regression analysis, three independent variables

Q113: i. The coefficient of correlation is a

Q114: i. A scatter diagram is a chart