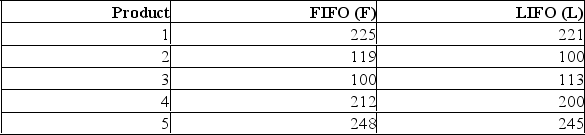

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

What is the null hypothesis?

Definitions:

Income Statement

A financial statement that reports a company's financial performance over a specific accounting period, detailing revenue, expenses, and net profit or loss.

Accounting Equation

A basic principle of accounting that represents the relationship between an entity's assets, liabilities, and owners' equity (Assets = Liabilities + Owners' Equity).

Accounts Payable

Obligations a company owes to its suppliers or creditors for goods and services received but not yet paid for.

Cash

Liquid currency and coins that are accepted as a medium of exchange for goods and services.

Q6: The employees at the East Vancouver

Q16: i. For a one-tailed test using the

Q24: (i. The formula to convert any

Q27: A company is researching the effectiveness of

Q51: (i. The formula to convert any

Q86: What is the range of values for

Q86: The average score of 100 students taking

Q87: The z-value associated with a 96% level

Q117: What is the difference between a confidence

Q160: i. A coefficient of correlation close to