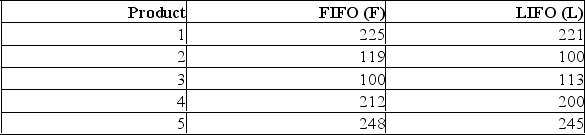

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

If you use the 5% level of significance, what is the critical t value?

Definitions:

Problem-solving Ideas

Creative and practical solutions aimed at overcoming challenges or obstacles in various contexts, such as product development, customer service, or workflow improvements.

Adviser

An expert who provides professional or specialized guidance and recommendations in a particular field.

Predawn Delivery

A logistics term referring to the delivery of goods or services before the beginning of the working day.

Replace the Food

An action typically taken in the service industry, particularly in restaurants, where a customer's unsatisfactory meal is replaced at no extra charge.

Q16: Twenty-one executives in a large corporation were

Q22: To compare the effect of weather

Q23: i. The rejection region for analysis of

Q33: The mean weight of newborn infants

Q34: Alpha Corporation receives a shipment of flour

Q75: Suppose we select every fifth invoice in

Q95: The best example of a null

Q116: i. A correlation coefficient of -1 or

Q125: Information was collected from employee records to

Q127: It has been hypothesized that overall academic