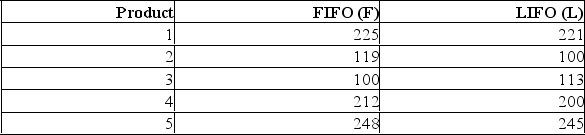

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Marketing Concept

A business philosophy emphasizing customer needs and satisfaction as the key to achieving organizational goals.

Paradigm Shift

A fundamental change in the approach or underlying assumptions of a particular field or discipline.

Flatter Organizational Structure

An organizational design with fewer levels of hierarchy, encouraging better communication and faster decision-making between upper management and employees.

Customer Service

The assistance and support provided by a company to the people who buy or use its products or services.

Q7: The mean weight of trucks traveling on

Q20: Given the following five points: (-2,0), (-1,0),

Q39: In correlation analysis, the dependent variable is<br>A)

Q42: i. A continuity correction compensates for estimating

Q53: The correlation between two variables is 0.29

Q56: Of 150 adults who tried a new

Q68: The null hypothesis makes a claim about

Q120: Which of the following is NOT a

Q129: Suppose a tire manufacturer wants to set

Q141: i. Trying to predict weekly sales with