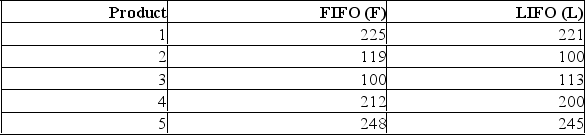

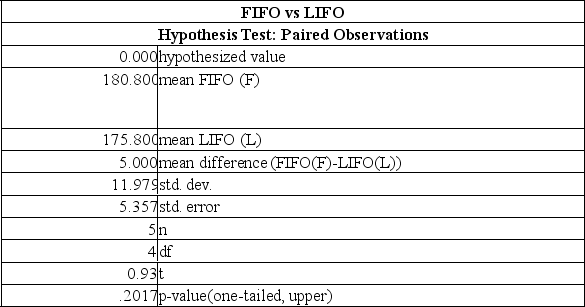

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Debit Side

The Debit Side of an account records increases in assets or expenses and decreases in liabilities, equity, and income in double-entry bookkeeping.

Rules Of Debit

Rules governing the increase or decrease in account balances within the double-entry bookkeeping system, where debits typically increase assets or expenses and decrease liabilities, equity, and revenue.

Credit Side

The right side of an accounting entry, indicating increases in liabilities, revenues, and equity, and decreases in assets and expenses.

Normal Balance

The side (debit or credit) on which increases to an account are recorded, depending on the type of account.

Q4: (i. The interval estimate states the

Q25: i. The coefficient of determination is the

Q25: A retailer claims that 90% of its

Q62: What are the degrees of freedom associated

Q66: i. If probability sampling is done, each

Q80: i. The Empirical Rule of probability can

Q91: How is the Y intercept in the

Q112: If an employee wanted to investigate the

Q153: Information was collected from employee records to

Q166: A sales manager for an advertising agency