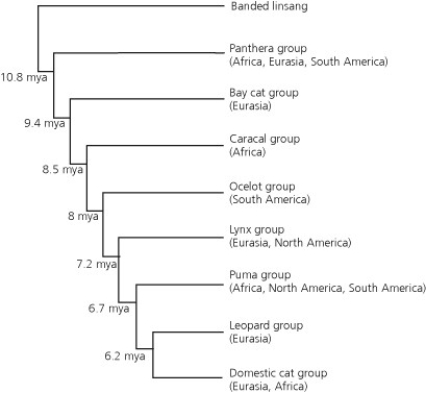

The family Felidae (cats) is distributed across Africa, Eurasia, North America, and South America and is hypothesized to have eight major lineages (Panthera, bay cat, caracal, ocelot, lynx, puma, leopard, and domestic cat groups) as shown in this phylogenetic tree, constructed from DNA sequences. Scientists used a molecular clock and fossil evidence to date the divergence of each group. The dates of divergence are provided in the accompanying figure.

-Scientists have observed that for several species of smaller Felidae (such as ocelots and wild members of the domestic cat group) , individuals that are kept in zoos become tame, that is, friendly to humans. This behavior is a ________ that may have made domestication of the house cat's ancestor more likely.

Definitions:

Financial Models

Quantitative tools built to represent the performance of a financial asset or portfolio, often used for forecasting and decision making.

Leveraged Firm

A company that uses borrowed capital or debt to fund its operations and investments, aiming to increase potential returns to shareholders.

Risk-Free Rate

The return on investment with no risk of financial loss, typically represented by the yield on government securities.

Market Risk Premium

The extra return investors demand for choosing to invest in the market over a risk-free asset.

Q12: If the atomic mass of uranium is

Q13: Which of the following types of reproductive

Q16: In the genetic code<br>A) some codons specify

Q29: In plants, the process of photosynthesis produces

Q35: What is direct democracy, and how is

Q41: The red throat found in reproductively mature

Q43: Which model is best studied through a

Q49: In 1865, a biologist, St. George Jackson

Q53: While wading in the ocean, you look

Q73: Compost piles create an intense heat source