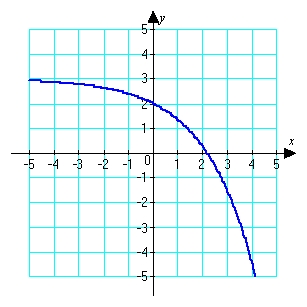

Use the graph to determine whether  is positive or negative.

is positive or negative.

Definitions:

Deductibility

Deductibility refers to the eligibility of an expense to be subtracted from gross income to reduce taxable income, based on IRS guidelines.

Schedule C

A form used by sole proprietors to report income and expenses from a business or profession to the IRS.

Schedule E

A form used with the Form 1040 for reporting income from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests.

Tax Purposes

Criteria or activities specifically considered or accounted for in the calculation or management of taxes.

Q1: List the evaluation points corresponding to the

Q11: What is the maximum hydrostatic force a

Q19: Estimate the error in using <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2342/.jpg"

Q47: An electrical power supply, such as a

Q68: Find the general antiderivative. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2342/.jpg" alt="Find

Q74: Starting with the parametric arc length formula

Q86: Prove that <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2342/.jpg" alt="Prove that

Q87: Use Simpson's Rule to estimate the volume

Q110: Find the derivative of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2342/.jpg" alt="Find

Q128: A bacterial population starts at 300 and