Use the following information and figure to answer the question.

The sea slug Pteraeolidia ianthina (P. ianthina) can harbour living dinoflagellates (photosynthetic protists) in its skin. These endosymbiotic dinoflagellates reproduce quickly enough to maintain their populations. Low populations of the dinoflagellates do not affect the sea slugs very much, but high populations (> 5 x 105 cells/mg of sea slug protein) can promote sea slug survival.

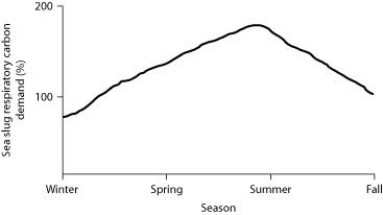

Percent of sea slug respiratory carbon demand provided by indwelling dinoflagellates.

-

If we assume that carbon is the sole nutrient needed by sea slugs to drive their cellular respiration, then based on the graph, during which season(s) is it least necessary for P. ianthina to act as a chemoheterotroph?

Definitions:

Employer Contributions

Employer contributions refer to the amounts added by an employer to an employee's benefits or retirement savings accounts, such as a 401(k) plan, often matching the employee's contributions up to a certain percentage.

Tax-Deferred Plans

Investment accounts, such as IRAs or 401(k)s, where contributions may reduce taxable income in the year made, with taxes paid later upon withdrawal.

Accumulation Period

The phase in some investment vehicles, such as annuities, during which an investor builds up their investment value through payments or investment returns.

Distribution Period

The timeframe over which payments are made from a retirement or investment account to the account holder.

Q1: Which of the following viruses would most

Q10: Which of the following correctly lists the

Q34: In 1983, a population of dark-eyed junco

Q48: The figure depicts the outline of a

Q50: The figure depicts the outline of a

Q58: Ecologists often build models to depict the

Q59: Liverworts, hornworts, and mosses are grouped together

Q62: For several decades now, amphibian species worldwide

Q67: If the experimental population of E. coli

Q83: If a lung were to be found