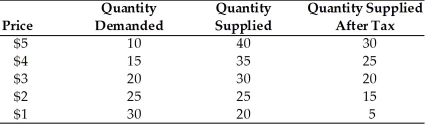

-The demand and supply of a product is given in the above table. A unit tax of $2 is imposed on the product. The equilibrium quantity for this product after the tax is imposed is equal to

Definitions:

Interest Rates

The percentage of principal charged by the lender for the use of its money, affecting loans, mortgages, and savings.

MM Extension

Refers to the extensions of Modigliani and Miller's theory on capital structure, which further explore the impacts of taxes, bankruptcy costs, and other market imperfections.

Tax Shield

A tax shield is a deduction, exclusion, or exemption from taxable income, allowing individuals or entities to pay lower taxes by reducing their taxable income through certain allowable expenses or investments.

Levered Cost of Equity

The rate of return required by shareholders of a company that employs debt in its capital structure, reflecting the increased risk.

Q13: The government might provide a subsidy when<br>A)a

Q55: Which government agency compiles the consumer price

Q110: Static tax analysis assumes<br>A)all of the present

Q133: A state tax assessed specifically on cigarettes

Q172: The real rate of interest equals 8%,and

Q188: Market failure occurs when<br>A)the price system fails

Q197: When comparing market and public sector decision

Q212: Refer to the above figures.Which of the

Q246: Your local grocery store reduces transaction costs

Q374: The definition of a job loser is