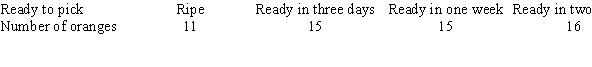

A random group of oranges were selected from an orchard to analyze their ripeness. Based on the time of year, the orchard owner believes that 20% of the oranges are ready for picking now, 40% will be ready in three days, 30% will be ready in one week, and 10% will be ready in two weeks. Is there evidence to reject this hypothesis at  = 0.05?

= 0.05?

Definitions:

AGI

Adjusted Gross Income, an individual's total gross income minus specific deductions, used in the United States tax system to determine taxable income.

Dependent Daughters

This term is not an official tax term but generally refers to daughters who qualify as dependents on someone's tax return due to financial support and other IRS criteria.

AGI

Adjusted Gross Income, which is gross income minus allowable deductions, used to determine taxable income on an individual's federal income tax return.

Modified AGI

Adjusted Gross Income adjusted by adding back certain deductions, often used to determine eligibility for various tax credits and retirement plans.

Q18: A portion of an ANOVA summary table

Q21: The survey question "Since everybody likes baseball,

Q23: The amount of time needed to run

Q35: Find the chromatic number of the graph

Q42: A contingency table is made up of

Q43: If a card is drawn from an

Q44: Choose the packing that results from

Q45: The table lists the number of students

Q54: Give an example in which the first-fit

Q65: For the graph below, which routing is